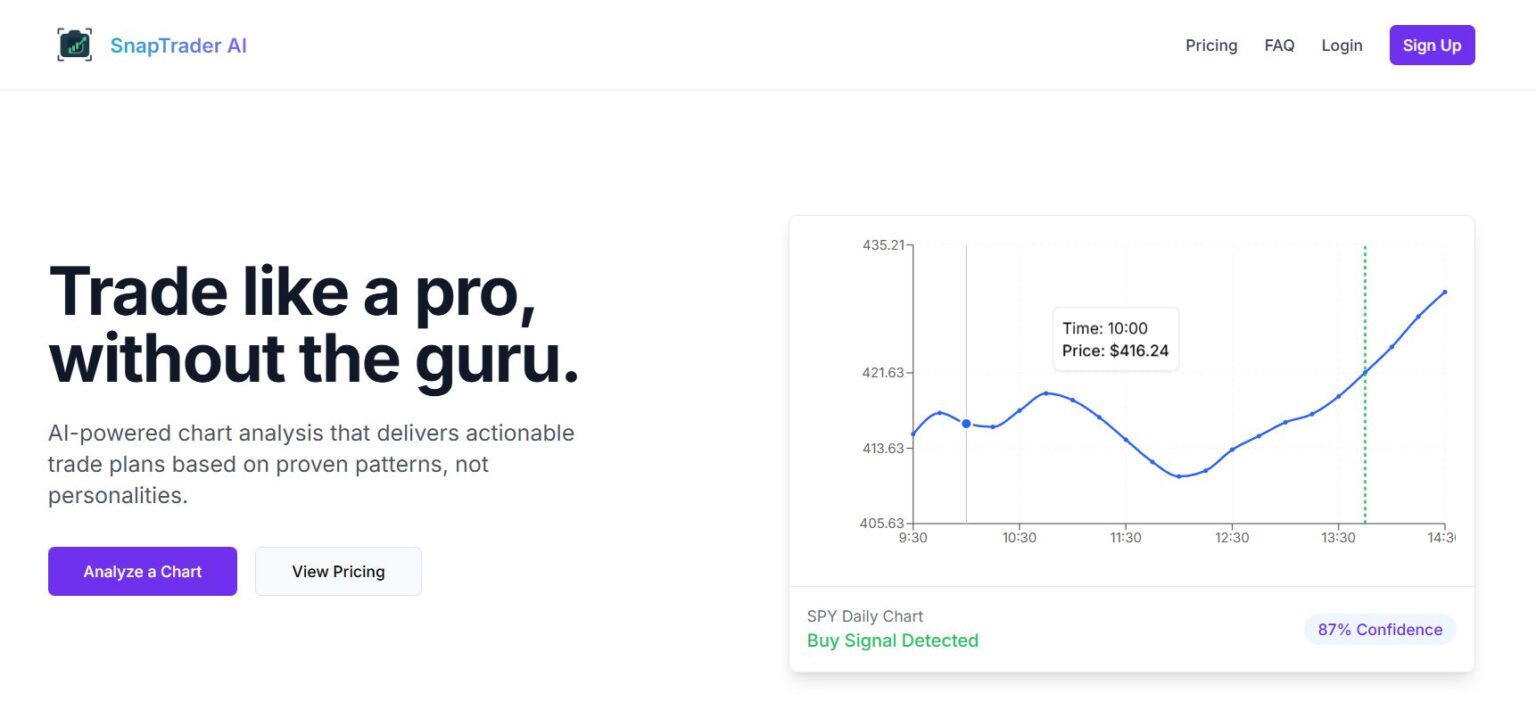

SnapTrader AI is an AI-driven trading platform that helps traders — from beginners to experienced investors.

Analyze financial markets, generate trading signals, and execute automated trades in cryptocurrency and other digital assets using advanced machine learning and pattern-recognition algorithms.

The platform aims to take the guesswork out of trading by offering real-time analytics, automatic signals, and bot execution tools.

What Is SnapTrader AI?

SnapTrader AI is an automated trading assistant and analytics dashboard that uses artificial intelligence to scan market data, identify patterns, and deliver actionable trading insights and execution signals to users.

It blends AI chart analysis, trend detection, and automated bot trading — making market participation more accessible for traders who may not want to do manual charting all day.

Unlike simple signal services, SnapTrader provides an integrated trading experience by helping users connect to brokers or exchange accounts, set trading parameters, and potentially automate orders based on AI-generated insights.

Core Features

📊 AI-Powered Chart Analysis

SnapTrader uses machine-learning algorithms to analyze price charts, technical indicators, and historical trends to produce actionable trade plans and signals.

🤖 Automated Trading Capabilities

The platform supports both semi-automated and fully automated trading, allowing the AI to propose or execute trades based on predefined risk settings.

📈 Real-Time Market Scanning

By constantly monitoring multiple markets and asset movements, SnapTrader can generate signals and alerts for potential entry or exit points.

📱 Web-Based Interface

SnapTrader is typically accessed via browser — optimized for both desktop and mobile dashboards without needing native apps.

🪙 Multi-Asset Coverage (Reported by reviews)

While focused on crypto trading, some integrations and extensions claim support for other asset classes (like forex or CFDs) through partnered brokers or exchanges.

💡 Risk & Strategy Parameters

Users can customize risk levels, trade size, and strategy style so that the AI’s execution aligns with their own investment preferences.

How It Works

- Sign Up & Verify:

Create an account on the SnapTrader AI website and complete any required identity verification (KYC) — often required by regulated broker integrations. - Connect to a Broker or Wallet:

Link your preferred trading account or supported exchange connection. The platform itself usually does not hold funds — trades are executed through your broker or exchange. - Set Trading Preferences:

Choose risk parameters, assets to trade, and whether you want automated execution or signal alerts. - AI Analysis & Signals:

The AI scans markets in real time and delivers trade ideas based on technical patterns and indicators. - Trade Execution:

Depending on settings, SnapTrader can execute orders automatically or await your approval before placing trades.

Who It’s For

✔ Beginner Traders: Users without deep technical analysis experience who want an AI assist.

✔ Active Traders: People who want faster signal generation and pattern recognition.

✔ Automated Trade Enthusiasts: Those looking to reduce manual trading and fatigue.

✔ Crypto Investors: Individuals focused on cryptocurrency markets can use the platform’s real-time analytics and bot features.

Pricing & Costs

Pricing models reported vary, with some sources citing free access for basic capabilities and paid premium tiers (~$9–$29/month) for advanced analysis and faster data.

Some reviews also mention that trading itself does not incur additional SnapTrader subscription fees, though trading costs (like spreads, exchange fees, or broker costs) may still apply.

Pros & Highlights

✔ Intuitive Interface: A clean and easy-to-use dashboard for analyzing charts and signals.

✔ AI-Driven Insights: Helps scan markets and identify patterns faster than manual analysis.

✔ Automation Options: Offers both signals and automated execution modes.

✔ Multi-User Appeal: Geared toward beginners and intermediate traders alike.

Considerations & Risks

⚠ Market Risk: No AI can guarantee profits — all trading involves significant risk, especially in volatile crypto markets. Always trade only with capital you can afford to lose.

⚠ Regulatory Status: SnapTrader AI itself is generally not a regulated broker — compliance and protections come from the brokers it connects to.

⚠ User Reviews Mixed: Some user feedback (e.g., on Trustpilot) indicates inconsistent performance or support issues, with low averages on some review aggregators.

⚠ Transparency: As with many AI trading tools, exact algorithm methodology and performance claims should be viewed with caution and independently evaluated.

Final Thoughts

SnapTrader AI is part of the growing wave of AI-augmented trading platforms that aim to bring real-time analytics, automated signals, and machine-assisted execution to retail traders — especially in cryptocurrency markets.

While it offers powerful automation and insights that may help reduce manual analysis time, it also carries typical market and algorithmic risks inherent in any trading tool.

Users should approach with prudent risk management, understand underlying broker requirements, and use demo modes or small capital tests before scaling their trading activities.